Seriously! 45+ Facts About Capital Structure Theory In General Assumes That: They Did not Let You in!

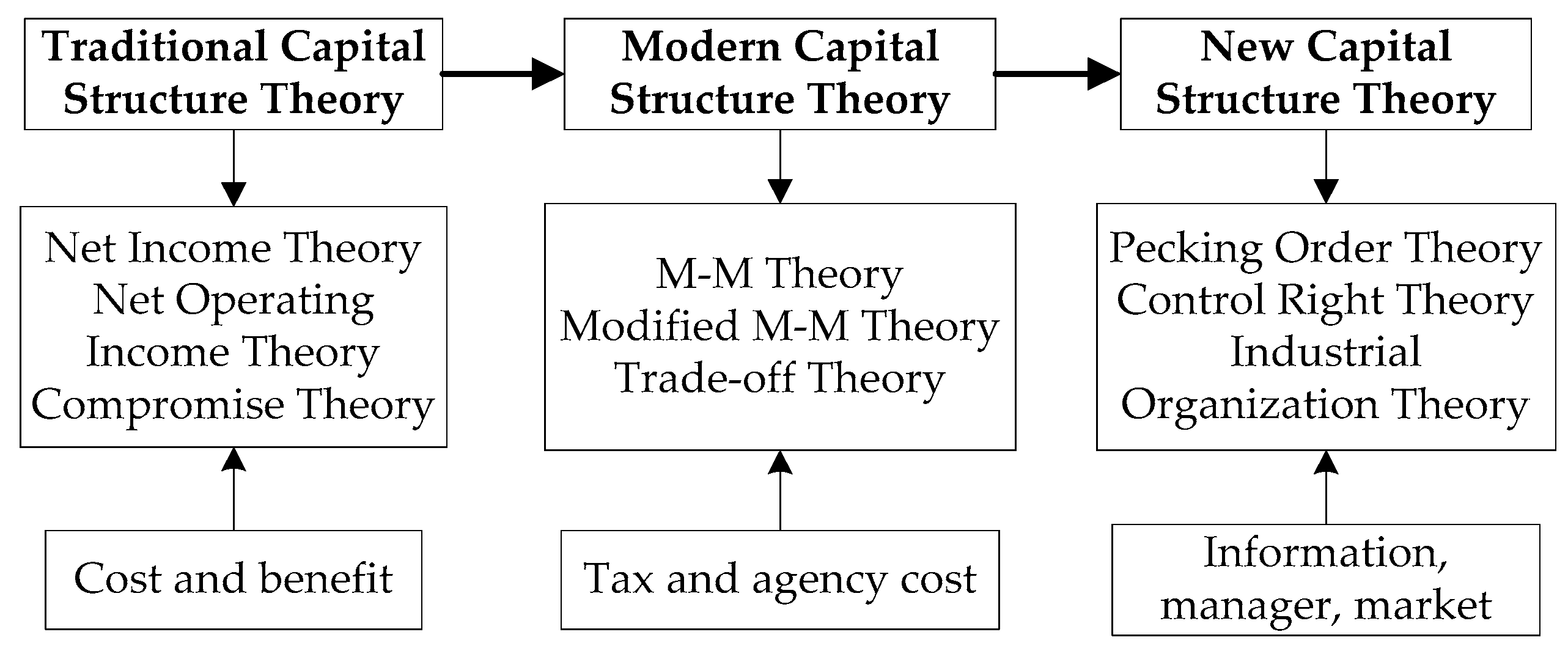

Capital Structure Theory In General Assumes That: | We also note that the estimates in. Capital structure categorizes the way a company has its assets financed. The pecking order theory assumes that there is no target capital structure. It tests three major capital structure theories (e.g. Pecking order theory assumed that there is no optimal structure where companies prefer internal (income) financing rather than external (debt) in general, the results show that the explanatory power of the models is relatively high and significant which indicates that the construct validity of the.

The firms choose capitals according to the following preference order: The business risk is assumed to be constant and independent of capital structure and financial risk. Evidence on capital structure viii. We also note that the estimates in. Other theories of & issues in capital structure theory vii.

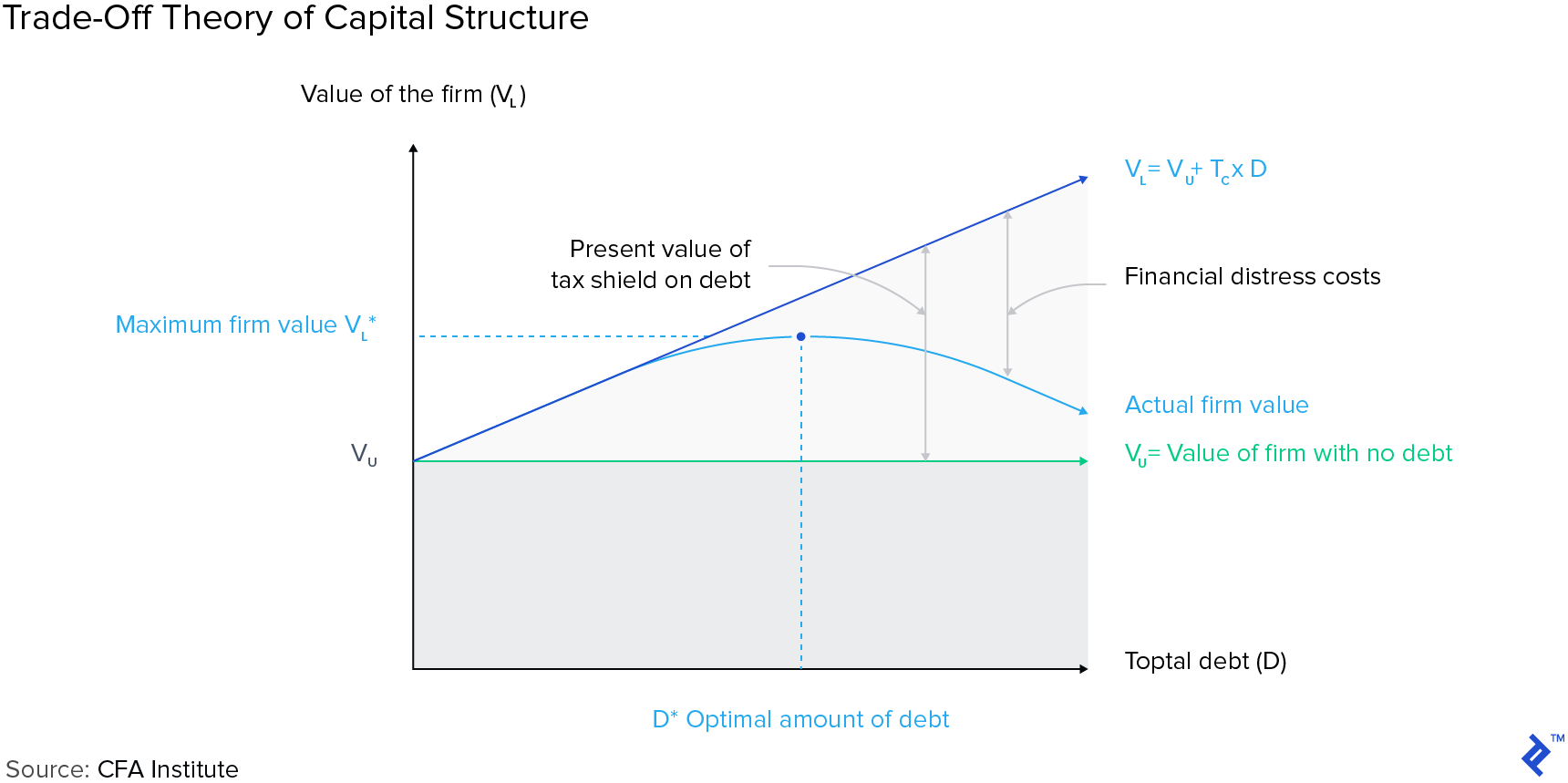

The debt capitalisation rate is less than the equity capitalisation rate 3. Modigliani and miller approach to capital theory, devised in the 1950s advocates capital structure irrelevancy theory. Miller and modigliani developed a theory which through its assumptions and in general, since dividend payments are not tax deductible but interest payments are, one would think that, theoretically, higher corporate tax rates. It is the theory of capital structure irrelevance that a firm's value depends on the ability of its assets to create value. The css theory hypothesizes that managements of public companies manipulate capital structure such that earnings per share (eps). The pecking order theory assumes that there is no target capital structure. The decrease in interest would increase the net income and thereby the eps and it is a general belief that the increase in eps leads to an increase. • assume two firms have identical assets that produce the same stream of operating profit and differ only in their capital structure. Evidence on capital structure viii. The key insight of dynamic theory in general is that the capital structure decisions heavily depend on the expectations and the costs of adjustment. It tests three major capital structure theories (e.g. This suggests that the valuation of a. Pecking order theory states that managers prefer financing choices that send the least visible signal to investors, with internal capital being most preferred, debt being next, and raising.

Still, the protection given by such. The corporate income taxes do not exist. In general, we have inadequate understanding of corporate financing behavior, and of how that behavior affects security returns. further, the mm model adds a behavioural justification in favour of the noi approach (personal leverage). The pecking order theory of capital structure assumes that firms have a preference ordering for capital sources.

Capital structure and corporate financing decisions: This valuable resource takes a practical approach to capital structure by discussing why various theor. We focus on the capital structure issue in chapter 17 where we explore the assumption underlying the famous these difficulties justify the fact that most of capital market theory either is silent on the issue of heterogeneity (in particular, when it adopts the arbitrage approach) or explicitly assumes. Learn how capital structure theory relates to financial management and the methods in which companies attempt to raise capital and market values. In this fixed pie view, the key choice was the the operative. Therefore seen as a complicated 'nexus of. Early theory focused on capital structure as a way to carve up a fixed amount of. Capital structure theory in general assumes that:a firm's value is determined by discounting the firm's expected cash flows by the wacc. Cost of capital, or expected earnings, or both why is it important? Capital structure categorizes the way a company has its assets financed. Internal financing is the first. The pure mm theory predicts. Capital structure affects the value of the firm by affecting either:

Evidence on capital structure viii. The corporate income taxes do not exist. The css theory hypothesizes that managements of public companies manipulate capital structure such that earnings per share (eps). Early theory focused on capital structure as a way to carve up a fixed amount of. · the first line of attack on the irrelevance result uses the argument.

The theory proves that the cost of capital is not affected by changes in the capital structure or (b) when the corporate taxes are assumed to exist: A systematic review, journal of advances in management research. · capital structure theory asks what is the optimal composition between debt and equity. The decrease in interest would increase the net income and thereby the eps and it is a general belief that the increase in eps leads to an increase. Therefore seen as a complicated 'nexus of. Modigliani and miller, in their article of 1963 have thus, the optimum capital structure can be achieved by maximising the debt mix in the equity of a firm. The key insight of dynamic theory in general is that the capital structure decisions heavily depend on the expectations and the costs of adjustment. Miller and modigliani developed a theory which through its assumptions and in general, since dividend payments are not tax deductible but interest payments are, one would think that, theoretically, higher corporate tax rates. Rumeysa bilgin, optimal capital structure for maximizing the firm value, valuation challenges and solutions in contemporary businesses yukti bajaj, smita kashiramka, shveta singh, application of capital structure theories: Learn how capital structure theory relates to financial management and the methods in which companies attempt to raise capital and market values. Modigliani and miller approach to capital theory, devised in the 1950s advocates capital structure irrelevancy theory. Other theories of & issues in capital structure theory vii. The pure mm theory predicts.

Capital Structure Theory In General Assumes That:: The corporate income taxes do not exist.

0 Response to "Seriously! 45+ Facts About Capital Structure Theory In General Assumes That: They Did not Let You in!"

Post a Comment